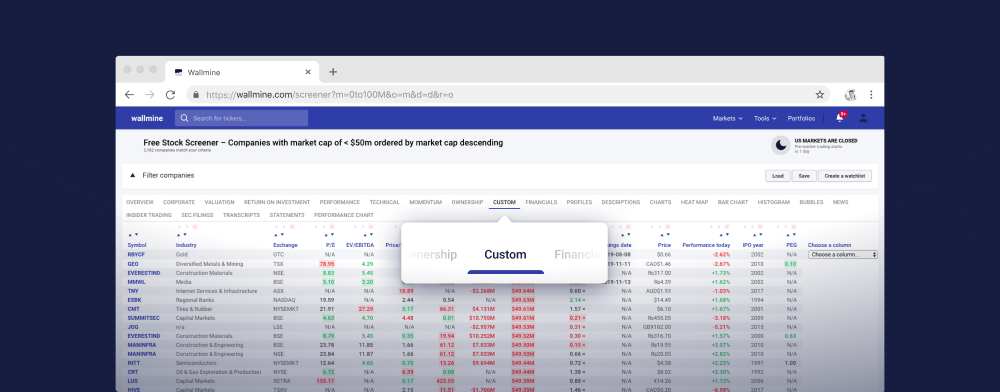

Akciový screener zadarmo

Load Uložiť Sledovací zoznam Help

Ameritrust Corporation does not have significant operations. It focuses on acquiring, holding, developing, and operating commercial real estate properties. The company was formerly known as Gryphon Resources, Inc. and changed its name to Ameritrust Corporation in August 2020. The company was founded in 2006 and is based in Cheyenne, Wyoming. Ameritrust Corporation is a subsidiary of Tourmeline Ventures, Inc.

- Ameritrust Corporation, 1712 Pioneer Avenue, Cheyenne 82001, United States

- 918 610 8080

- ameritrusttulsa.com

- Investor relations

Bank of China Limited, together with its subsidiaries, provides banking and related financial services. It operates through six segments: Corporate Banking, Personal Banking, Treasury Operations, Investment Banking, Insurance, and Other Operations. The Corporate Banking segment offers current accounts, deposits, overdrafts, loans, trade-related products and other credit facilities, foreign exchange, derivatives, and wealth management products to corporate customers, government authorities, and financial institutions. The Personal Banking segment provides savings deposits, personal loans, credit and debit cards, payments and settlements, wealth management products, and funds and insurance agency services to retail customers. The Treasury Operations segment is involved in the foreign exchange transactions, customer-based interest rate and foreign exchange derivative transactions, money market transactions, proprietary trading, and asset and liability management. The Investment Banking segment offers debt and equity underwriting, financial advisory, stock brokerage, investment research and asset management, and private equity investment services, as well as sells and trades in securities. The Insurance segment underwrites general and life insurance products; and provides insurance agency services. As of December 31, 2020, the company operated approximately 11,550 institutions, including 10,991 institutions in Chinese mainland; and 559 institutions in Hong Kong, Macau, Taiwan, and other countries. It is also involved in the aircraft leasing business. The company was founded in 1912 and is headquartered in Beijing, China. Bank of China Limited is a subsidiary of Central Huijin Investment Limited.

- Bank of China Limited, No. 1 Fuxingmen Nei Dajie, Beijing 100818, China

- 86 10 6659 6688

- boc.cn

- Investor relations

BACHF

Bank of China Limited, together with its subsidiaries, provides banking and related financial services. It operates through six segments: Corporate Banking, Personal Banking, Treasury Operations, Investment Banking, Insurance, and Other Operations. The Corporate Banking segment offers current accounts, deposits, overdrafts, loans, trade-related products and other credit facilities, foreign exchange, derivatives, and wealth management products to corporate customers, government authorities, and financial institutions. The Personal Banking segment provides savings deposits, personal loans, credit and debit cards, payments and settlements, wealth management products, and funds and insurance agency services to retail customers. The Treasury Operations segment is involved in the foreign exchange transactions, customer-based interest rate and foreign exchange derivative transactions, money market transactions, proprietary trading, and asset and liability management. The Investment Banking segment offers debt and equity underwriting, financial advisory, stock brokerage, investment research and asset management, and private equity investment services, as well as sells and trades in securities. The Insurance segment underwrites general and life insurance products; and provides insurance agency services. As of December 31, 2020, the company operated approximately 11,550 institutions, including 10,991 institutions in Chinese mainland; and 559 institutions in Hong Kong, Macau, Taiwan, and other countries. It is also involved in the aircraft leasing business. The company was founded in 1912 and is headquartered in Beijing, China. Bank of China Limited is a subsidiary of Central Huijin Investment Limited.

- Bank of China Ltd., No. 1 Fuxingmen Nei Dajie, Beijing 100818, China

- 86 10 6659 6688

- boc.cn

- Investor relations

China Construction Bank Corporation provides various banking and related financial services to individuals and corporate customers in the People's Republic of China and internationally. It operates through Corporate Banking, Personal Banking, Treasury Business, and Others segments. The company accepts various deposits, such as foreign currency, all in one accounts, RMB, corporate term and notification, and corporate demand deposits, as well corporate deposits by agreement. Its loan products include personal business, car, and housing loans; and SME, traditional credit, commercial draft, buyer credit, and RMB credit line loans. The company also offers credit cards; physical gold for personal investment and personal gold accounts; foreign exchange services; certificate treasury and savings bonds, securities deposit accounts, and securities services, as well as bank-securities transfer and book-entry treasury bond over the counter services; and wealth management products. In addition, it provides collection, salaries payment, third-party collection and payment, insurance agency, and remittance services; international settlement and financing, and FI services; securities and fund settlement services; guarantee-based, consulting and advising, and factoring services; fund custody services; treasury, asset management, trustee, finance leasing, investment banking, and other financial services; and e-banking services. Further, the company offers institutional services comprising services for government agencies, social security, banks cooperation, bank-securities cooperation, bank-insurance cooperation, and services for non-banking financial institutions. As of December 31, 2020, it operated 14,741 banking outlets. China Construction Bank Corporation was founded in 1954 and is headquartered in Beijing, the People's Republic of China.

- China Construction Bank Corporation, No. 25, Financial Street, Beijing 100033, China

- 86 10 6621 5533

- ccb.com

- Investor relations

China Construction Bank Corporation provides various banking and related financial services to individuals and corporate customers in the People's Republic of China and internationally. It operates through Corporate Banking, Personal Banking, Treasury Business, and Others segments. The company accepts various deposits, such as foreign currency, all in one accounts, RMB, corporate term and notification, and corporate demand deposits, as well corporate deposits by agreement. Its loan products include personal business, car, and housing loans; and SME, traditional credit, commercial draft, buyer credit, and RMB credit line loans. The company also offers credit cards; physical gold for personal investment and personal gold accounts; foreign exchange services; certificate treasury and savings bonds, securities deposit accounts, and securities services, as well as bank-securities transfer and book-entry treasury bond over the counter services; and wealth management products. In addition, it provides collection, salaries payment, third-party collection and payment, insurance agency, and remittance services; international settlement and financing, and FI services; securities and fund settlement services; guarantee-based, consulting and advising, and factoring services; fund custody services; and e-banking services. Further, the company offers institutional services comprising services for government agencies, social security, banks cooperation, bank-securities cooperation, bank-insurance cooperation, and services for non-banking financial institutions. It operates 14,741 banking outlets. China Construction Bank Corporation was founded in 1954 and is headquartered in Beijing, the People's Republic of China.

- China Construction Bank Corp., No. 25, Financial Street, Beijing 100033, China

- 86 10 6621 5533

- ccb.com

- Investor relations

Industrial and Commercial Bank of China Limited, together with its subsidiaries, provides banking products and services in the People's Republic of China and internationally. It operates through Corporate Banking, Personal Banking, and Treasury Operations segments. The Corporate Banking segment offers financial products and services to corporations, government agencies, and financial institutions. Its products and services include corporate loans, trade financing, deposit-taking activities, corporate wealth management services, custody activities, various corporate intermediary services, etc. The Personal Banking segment provides financial products and services to individual customers. This segment's products and services comprise personal loans and cards, deposits, personal wealth management, personal intermediary services, etc. The Treasury Operations segment is involved in the money market transactions, investment securities, and foreign exchange transactions, as well as in the holding of derivative positions. The company also offers e-banking services, including Internet, telephone, and mobile banking services; and investment banking, fund and financial asset management, trust, financial leasing, broker dealer, securities margin and trading, insurance, and other financial services. It operates 16,653 institutions, including 16,227 domestic institutions and 426 overseas institutions. Industrial and Commercial Bank of China Limited was founded in 1984 and is headquartered in Beijing, the People's Republic of China.

- Industrial and Commercial Bank of China Limited, 55 Fuxingmennei Avenue, Beijing 100140, China

- 86 10 6610 6114

- icbc-ltd.com

- Investor relations

Industrial and Commercial Bank of China Limited, together with its subsidiaries, provides banking products and services in the People's Republic of China and internationally. It operates through Corporate Banking, Personal Banking, and Treasury Operations segments. The Corporate Banking segment offers financial products and services to corporations, government agencies, and financial institutions. Its products and services include corporate loans, trade financing, deposit-taking activities, corporate wealth management services, custody activities, various corporate intermediary services, etc. The Personal Banking segment provides financial products and services to individual customers. This segment's products and services comprise personal loans and cards, deposits, personal wealth management, personal intermediary services, etc. The Treasury Operations segment is involved in the money market transactions, investment securities, and foreign exchange transactions, as well as in the holding of derivative positions. The company also offers e-banking services, including Internet, telephone, and mobile banking services; and investment banking, fund and financial asset management, trust, financial leasing, broker dealer, securities margin and trading, insurance, and other financial services. It operates 16,653 institutions, including 16,227 domestic institutions and 426 overseas institutions. Industrial and Commercial Bank of China Limited was founded in 1984 and is headquartered in Beijing, the People's Republic of China.

- Industrial & Commercial Bank of China Ltd., 55 Fuxingmennei Avenue, Beijing 100140, China

- 86 10 6610 6114

- icbc-ltd.com

- Investor relations

Lloyds Banking Group plc provides range of banking and financial services in the United Kingdom and internationally. It operates through three segments: Retail; Commercial Banking; and Insurance and Wealth. The Retail segment offers a range of financial service products, including current accounts, savings accounts, mortgages, motor finance, unsecured loans, leasing solutions, and credit cards to personal and small business customers. The Commercial Banking segment provides lending, transactional banking, working capital management, risk management, term lending, and debt capital markets services to corporate clients. The Insurance and Wealth segment offers life, home, and car insurance products; pensions and investment products; and advisory services in areas, including investments, planning for retirement, and protection and inheritance tax planning, as well as personal lending. It also provides digital, telephony, and mobile services. The company offers its products and services under the Lloyds Bank, Halifax, Black Horse, Agricultural Mortgage Corporation, Schroders Personal Wealth, Lex Autolease, Birmingham Midshires, MBNA, LDC, Bank of Scotland, and Scottish Widows brands. Lloyds Banking Group plc was founded in 1695 and is headquartered in London, the United Kingdom.

- Lloyds Banking Group Plc, 25 Gresham Street, London EC2V 7HN, United Kingdom

- 44 20 7626 1500

- lloydsbankinggroup.com

- Investor relations

Agricultural Bank of China Limited provides corporate and retail banking products and services. The company operates through Corporate Banking, Personal Banking, and Treasury Operations segments. It offers demand, personal call, foreign currency time, foreign currency call, time or demand optional, foreign exchange demand, foreign exchange call, foreign exchange time, certificates of deposit, savings, agreed-term, and negotiated deposits; and loans comprise housing, consumer, business, fixed asset, working capital, real estate, and entrusted syndicated loans, as well as trade finances, guarantees and commitments, and loans with custody of export rebates accounts. The company also provides credit card, debit card, payment and settlement, private banking, cash management, investment banking, custody, financial market, and financial institution services, as well as trading and wealth management services; and personal fund collection and automatic transfer services. In addition, it offers agro-related personal and corporate banking products and services; personal and online, telephone, mobile, self-service, television, and SMS banking services; financial leasing services; fund management services; assets custodian services; debt-to-equity swap and related services; and life, health, and accident insurance, as well as reinsurance products. As of December 31, 2021, the company had 22,807 domestic branches, including three specialized institutions, 4 training institutes, 37 tier-1 branches, 402 tier-2 branches, 3,348 tier-1 sub-branches, 18,961 foundation-level branch outlets and 50 other establishments; and 13 overseas branches in Hong Kong, Singapore, Seoul, New York, Dubai International Financial Centre, Tokyo, Frankfurt, Sydney, Luxemburg, Dubai, London, Macao, and Hanoi; and four overseas representative offices in Vancouver, Taipei, Sao Paulo, and Dushanbe. Agricultural Bank of China Limited was founded in 1951 and is based in Beijing, the People's Republic of China.

- Agricultural Bank of China Limited, No. 69, Jianguomen Nei Avenue, Beijing 100005, China

- 86 10 8510 9619

- abchina.com

- Investor relations

China Tower Corporation Limited provides telecommunication tower infrastructure services in the People's Republic of China. The company engages in the construction, maintenance, and operation of base station ancillary facilities, such as telecommunications towers and public network coverage in high-speed railways and subways, and large-scale indoor distributed antenna systems. It offers towers, and shelters or cabinets; and ancillary equipment to telecommunication services providers for installation of the telecommunications equipment. The company also provides maintenance services, including monitoring equipment operation, routine inspection, device breakdown handling, property upkeep, working environment protection, and operation analysis services. In addition, it offers power access, batteries, or back up power generation to the customers' telecommunications equipment; and indoor distributed antenna systems connecting telecommunication equipment, enabling them to receive and send indoor mobile telecommunication network signals, as well as mobile telecommunication network signals covering buildings, large venues, and tunnels. Further, the company provides backup power services to standby emergency power supply to corporate customers; battery exchange services to replaceable batteries to individual customers; and battery recharge services to corporate and individual customers, as well as engages in the provision of integrated information, power generation, and energy storage services. Additionally, it provides trans-sector site application and information services. The company was formerly known as China Communications Facilities Services Corporation Limited and changed its name to China Tower Corporation Limited in September 2014. China Tower Corporation Limited was incorporated in 2014 and is headquartered in Beijing, the People's Republic of China.